Canceling Student Debt Is The Easiest, Most Effective Stimulus Possible

And why critics are wrong about it

Welcome to the big Sunday edition of Progressives Everywhere!

In this edition, we:

Take a deep dive into the economics of student debt

Examine the Jim Crow voter laws being pushed in Georgia

Look at other news

Let’s get to it!

But first, thank you to our latest crowdfunding donors: Jane and Constance!

The Easiest, Most Effective Stimulus Possible

Imagine a policy that would provide immediate life-changing economic stimulus to 43 million American families, could have a massive positive ripple effect across much of the rest of the economy, is supported by a majority of voters, and would only require a single signature from President Joe Biden to enact, with no exhausting battle over the filibuster or messy reconciliation process needed. Sounds like it’d be a political no-brainer, right?

As with most things that involve the Democratic Party, would that it were so simple.

The debate over canceling some or all of Americans’ $1.7 trillion in outstanding student debt emerged again on the national stage last week. It was revived when President Biden was asked at a CNN town hall in Milwaukee whether he’d be willing to use executive authority to forgive up to $50,000 per debt-holder, as proposed by Sens. Elizabeth Warren and Chuck Schumer. Though Biden’s response wasn’t a surprise, its meandering and inaccurate particulars drew plenty of pushback and are worth examining for the sake of clarifying the terms of the debate.

But before I get to that economic data, a bit of context:

When he was a senator from Delaware, Biden represented the home of the credit card industry, and in 2005, he pushed hard for a law that made getting a fresh start via bankruptcy far more difficult, in part by making nearly all student debt ineligible to be discharged in the process. He was one of 18 Democrats to vote for the law, which completed the Senate’s 30-year tightening of the noose on student borrowers, a process that began under false pretenses during Biden’s first term in Washington. That’s not to say he’s the driving force behind the assault on student borrowers — there have been many more pernicious factors that have nothing to do with him — but Biden’s entire career in federal government has coincided with the ongoing limiting of relief options.

That said, circumstances are quite different now, over 15 years since that bankruptcy law was signed by George W. Bush. Student debt numbers have exploded since 2009, largely as a result of policy failures by the federal and state governments, a private sector choked by big business, and an arms race in higher education. As a result, student debt has been transformed from a nuisance into a massive financial anchor weighing down two generations of already disadvantaged Americans. The larger economy is also suffering from the ripple effect, and as always in the United States, people of color are experiencing the worst of it.

It’s no accident that young people are marrying later, delaying home-buying, and in many cases, not even having children. Financial insecurity fuels each of those economy-draining trends, and there is no greater source of financial insecurity for people under 40 than student debt.

With so many misnomers out there about student debt cancellation, here’s a primer on the circumstances that created this crisis and what ending it might look like.

Why Has Student Debt Ballooned?

The average student debt load is now a whopping $36,000 for the 43 million people with federal loans. The cause and effect here is deceptively simple: “The higher education attainment of the population has increased a lot and yet wages are stagnant. Consequently, people are carrying more debt than they were.”

That explanation, offered to me by Dr. Marshall Steinbaum, an economics professor at the University of Utah who has studied and published extensively on the topic, is borne out by some distressing top-line data: National median income has inched up 2.43% since 2009, while median student debt balance has skyrocketed by 17.97%.

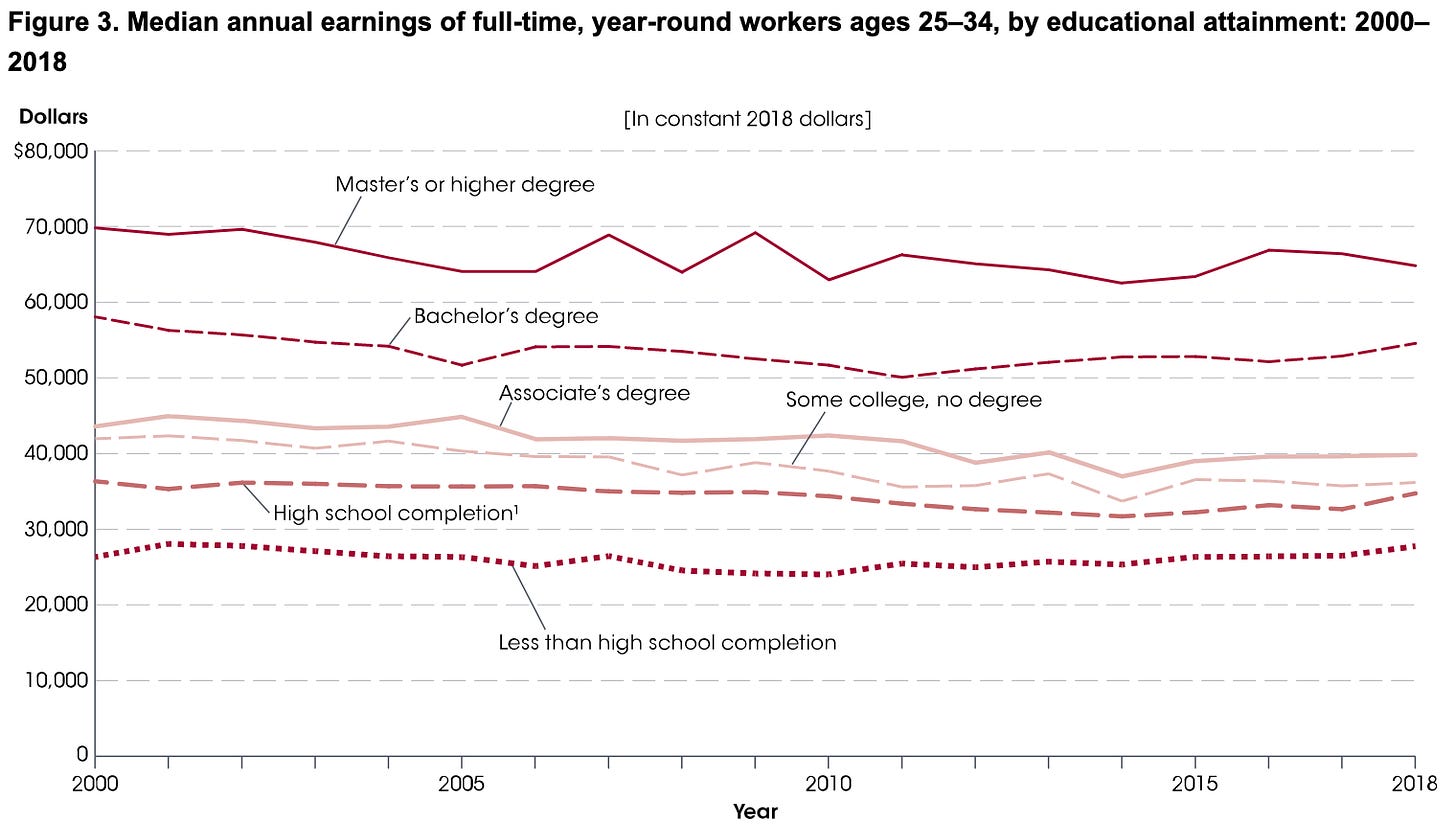

The median income numbers for young people (25-34) who worked full-time between 2000 and 2018 are even more distressing:

Some college education but no degree declined from $42,100 to $36,300 (-14%).

Associate’s degree declined from $43,700 to $40,000 (-9%).

Bachelor’s degree declined from $58,200 to $54,700 (-6%).

Here it is, visualized:

The income numbers are pretty straightforward, but that’s only half the equation. As wages have gone down, the cost of higher education has exploded, with the increase in tuition and fees most pronounced at public colleges:

Private universities: +144%

Public universities (out-of-state tuition): +165%

Public universities (in-state tuition): +212%

Tuition increases have coincided with an accelerated demand for higher education since the Great Recession. Since then, graduating millennials (I can attest to this, I graduated in 2008) have been faced with the worst economic prospects since the Great Depression, necessitating higher degrees to have a shot at a higher income. It’s a situation that has continued to get worse.

“That mountain of student debt that we have right now is basically the result of a few different phenomena,” Steinbaum says, “especially the withdrawal of state funding for public higher education systems as well as the credentialized labor market, where workers need to get more education to get a job and thus take on more debt while tuition is going up.”

Another major factor: Interest rates. As people struggle to pay back their loans, interest continues to compound, which winds up increasing the actual debt load. Many borrowers spend their time paying off accruing interest and never actually touching the principal. More on that in a bit.

Who Is Most Impacted by Student Debt?

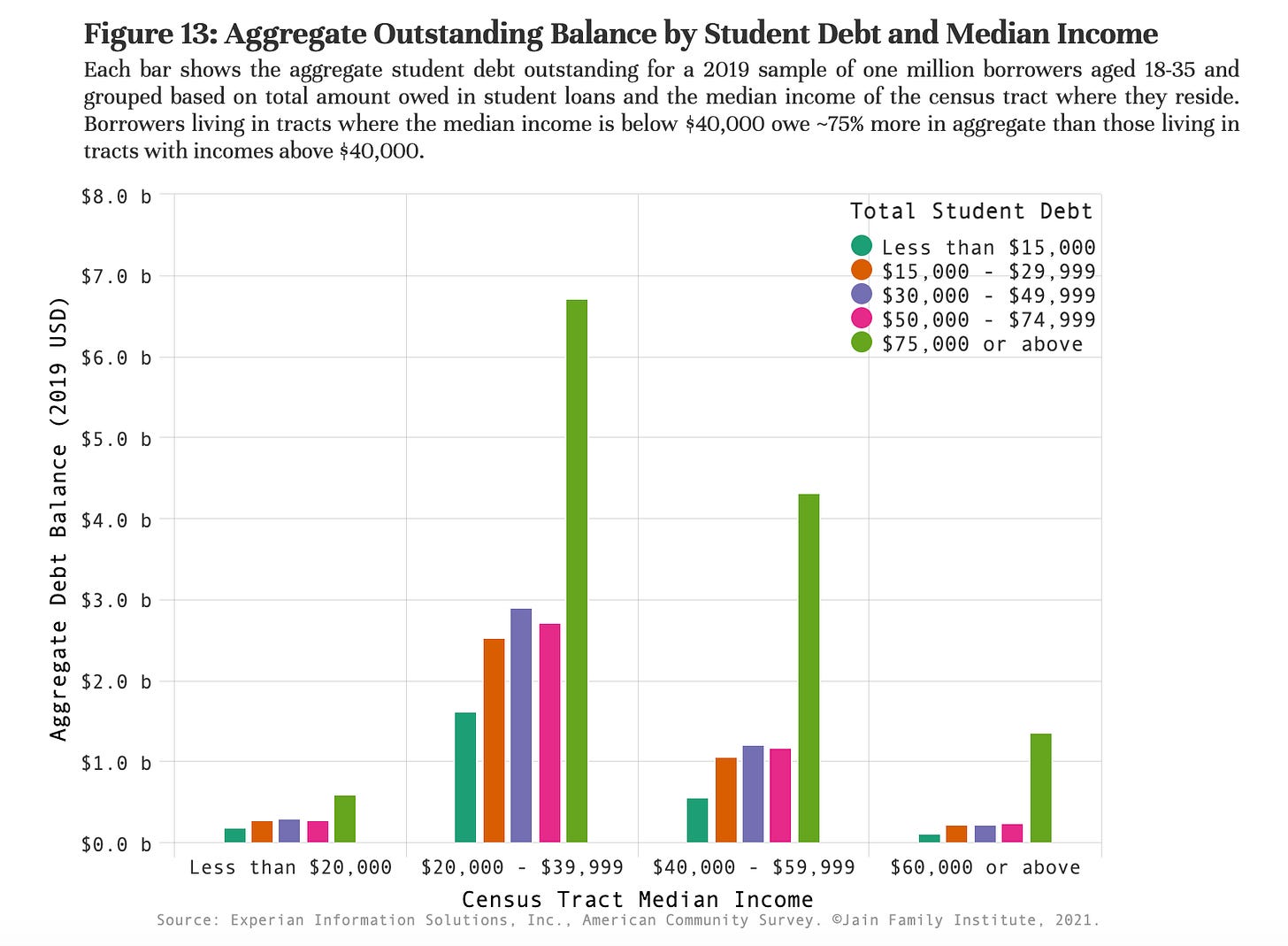

With 43 million debt-holders, it touches people of all demographics. But given the rising costs of education, wealth stratification, and the difficult job market in the United States, the burden is increasingly shifting to those with fewer resources.

“Rather than being a sign that somebody is more well-off than the population as a whole,” Steinbaum says, “having student debt is now a sign that they are worse off than the population as a whole.”

Again, the numbers are striking:

As you can see, the debt-to-income ratio for those with lower income levels is overwhelming and flat-out unsustainable. And the numbers on the higher end of the table are actually somewhat misleading, in that the people in the top two income brackets are actually less likely to have student debt altogether. Plus, they’re more able to quickly pay off the debt, which helps them avoid the huge interest rates that make these loans even more onerous.

“The people who don't have student debt are increasingly people who came into contact with a higher education system and were able to do so and exit it without having to take on student debt,” Steinbaum says. “Whereas people who do have student debt are increasingly people who come in contact with the higher education system and take out debt.”

Translation: Family wealth is a huge factor in determining whether someone takes out student debt, how much they take out, and how long it takes them to pay it back. In a 2019 report, Steinbaum found that

Where Does Race Come Into Play?

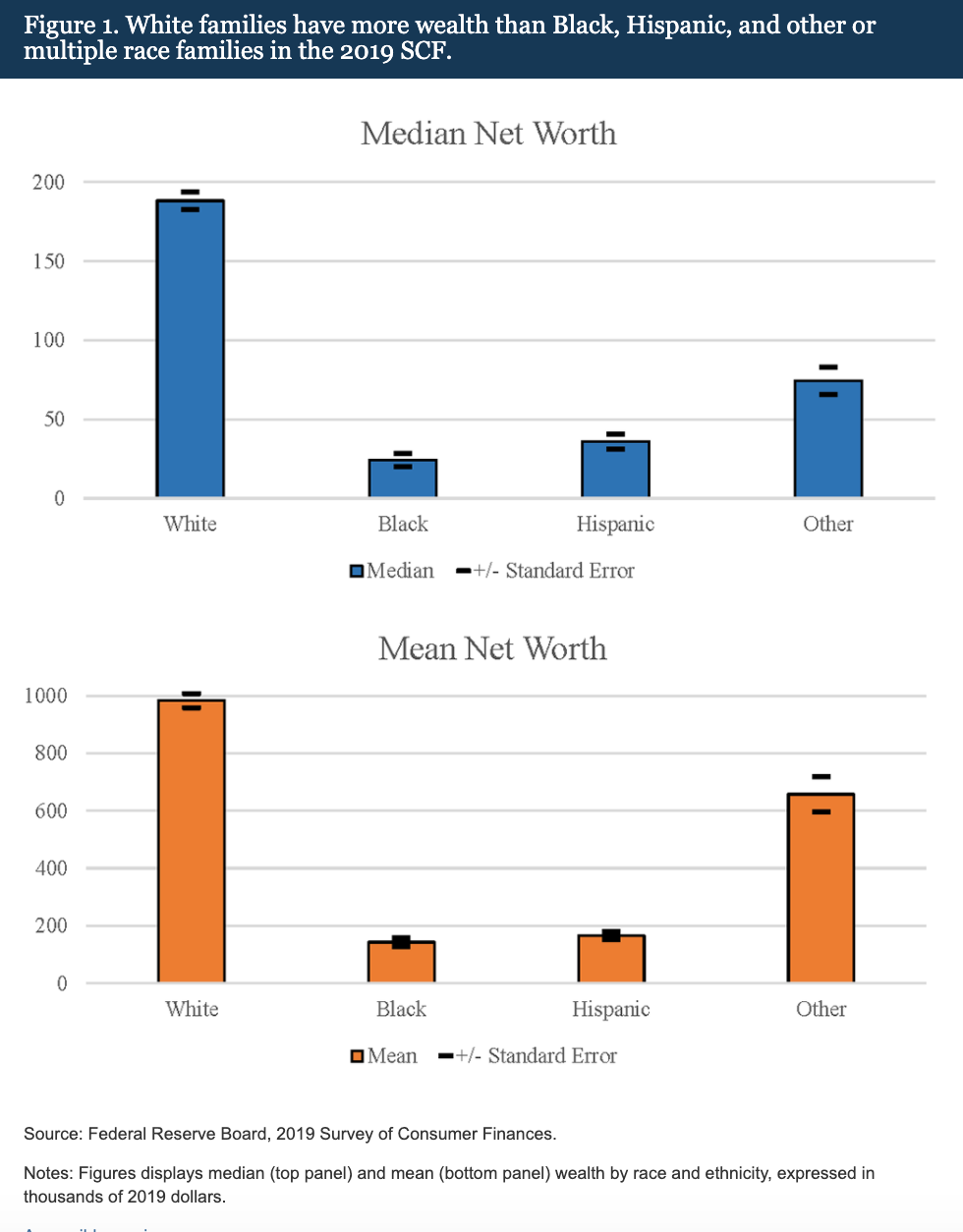

Simply put, in the United States, the average white family is far wealthier than the average minority family. As a direct result, student debt is far more burdensome to people of color, which in turn exacerbates the racial wealth gap.

In 2016, a Brookings Institute study found that the average Black student graduates with $7,400 more in student debt than the average white student, a difference that then explodes to $25,000 more within the next few years. Another study found that 20 years after graduation, the median white student has paid back about 94% of their loans, while the median black student still owes about 95%, or just over $18,500.

Even for Black borrowers who can pay, the debt acts as a reminder of the structural disadvantages that persist throughout the country. A study published this past winter noted that the average white family has a net worth of $171,000, while the average Black family’s savings is at just $17,500.

As a result, over 50% of Black people who have student debt say they owe more than their own net worth.

It’s also worth noting that we’re not just talking about young people. While people ages 25-34 owe $500 billion in federal student loans, adults between 35-49 owe $600 billion. Even seniors have a crush of student debt, with $262 billion on the ledger.

The crisis is overwhelming and all-encompassing, with few good available options. Even the most prominent repayment plan has fatal flaws that make it unsustainable and not particularly helpful for most borrowers.

How Do Income-Driven Repayment Plans Work… And Not Work?

There are a number of different repayment plans available to borrowers who qualify, the most prominent of which are the federal government’s four income-driven repayment programs. The program for low-income borrowers, Income-Based Repayment, caps monthly payments at 15% of one’s income (and it’s 10% for loans taken out after 2014) and offers plans that stretch up to 25 years. At that point, whatever is left of the loans is forgiven. Other plans offer similar terms.

Here’s the problem, though. As Steinbaum points out, interest rates continue to compound on the principal, and because people are making smaller payments, their total debt continues to rise over time. The programs are built around the assumption that people will quickly find jobs after graduation and be able to pay off both the principal and interest. But the credentialized job market and stagnant wages — not to mention the racial discrimination baked into the labor market — means that borrowers’ balances continue to rise.

As a result, people wind up simply throwing money at interest rates without ever touching the principal, forcing them to often pay more than they owed in the first place. And so, the offer of $10,000 in debt cancellation, as Biden has floated, would thus do little to help the people who need it most.

“It doesn't really solve the problem that IDR created, which is that the balances are rising over time and not being paid down,” Steinbaum says. “People in that situation, they're just waiting out the clock on IDR, so the $10,000 is essentially a meaningless thing for them.”

Why Is the Rich Kid Thing a Misnomer?

Raw numbers show that higher earners have a higher level of student debt, but as we’ve shown, income does not equal familial wealth. In many cases, those who hold the highest student debt numbers are from disadvantaged families and were unable to pay for their graduate degrees right away or pay off their debts soon after graduating. In particular, people of color who get higher degrees are more likely to get saddled with debt because they had to take out larger loans to attend those graduate programs.

It’s also worth noting that student debt cancellation applies to only those in the federal loan program, which is increasingly devoid of more wealthy graduates.

“The people who've already refinanced out of the federal system are likely the best credit risk, which means the best-off borrowers,” Steinbaum explains. “So the statements that have been made about how cancellation shouldn’t exist for well-off borrowers ignore the fact that a lot of well-off borrowers are already out at the federal system, which means that they're not eligible for cancellation, anyway.”

Plus, the more debt you forgive, the more disproportionate the help given to the disadvantaged borrower.

So why so much pushback? It’s not as if banks or creditors are likely to care much about the debt cancellation — they don’t own the debt, and in fact, they could reap big profits if young and middle-aged consumers all of a sudden gain about $1 trillion. It’s more likely that those with skin in the game at institutions of higher learning are afraid of what would come next: Regulations that ensure that the price of college stops spiraling and is in fact capped at a reasonable rate.

Biden could make this happen tomorrow if he wanted. It would relieve the debt burden on 43 million people and provide an unprecedented shot in the arm to the economy. People who are unable to pay rent, buy homes, have children, or start their own businesses would be free to pursue the American dream. Far from being regressive, loan cancellation would be a particular boost to people of color, who have been exploited and/or cast aside by banking, the labor market, and higher education for generations. There is no economic downside and it would cement support for Democrats for years to come.

Real Quick, Read This

We’ll get back to the news in a moment. But first…

This week, Progressives Everywhere surpassed over $5.9 million dollars raised for progressive Democratic candidates and causes. Isn’t that cool?

That said, none of that money goes to producing this newsletter or all of the related projects we put out there. Not a dime! In fact, it costs me money to do this. So to make this sustainable, I need your help.

I’m offering very low-cost premium subscriptions that offer a lot of goodies. If you become a member of Progressives Everywhere, you’ll get:

Premium member-only emails featuring analysis, insight, and local & national news coverage you won’t read elsewhere (for example!)

Exclusive updates from candidates and interviews with other progressive leaders.

Coverage of voting rights, healthcare, labor rights, and progressive activism.

The satisfaction of financing new projects like AbsenteeBallots.info and COVIDSuperSpreaders.com as well as a new student debt project

A new best friend (me).

You can also make a one-time donation to Progressives Everywhere’s GoFundMe campaign — doing so will earn you a shout-out in an upcoming edition of the big newsletter!

Important News You Need to Know

Voting Rights

Democracy is dying in darkness in Georgia right now. Literally.

Two subcommittees of the Georgia State Senate met at 7 am on Wednesday morning — 20 minutes before the sunrise — hoping to avoid scrutiny for the voter suppression that it was about to approve. With no live stream open to the public, the GOP-controlled subcommittees voted to four send bills that would end no-excuse absentee voting and require photo ID on absentee ballots on to the main Senate Ethics Committee.

Voters in Georgia have been able to vote via absentee ballot since 2005, and until this past election cycle, it was mostly used by older Republicans. Once it was embraced by Democrats, however, it magically became a tool for nefarious mass voter fraud, according to the state GOP, which is moving quickly to disenfranchise people in brand new ways after years of Brian Kemp’s voter purges.

On Thursday, Republicans in the State House went even further, as the infamously racist enemy of voting rights Rep. Barry Fleming dropped a huge 48-page omnibus voter suppression bill at 1:53 pm and then held hearings on it at 3 pm. And it is ferociously racist.

This bill is a multi-faceted attack on democracy. Some of its headline components include:

Photo ID requirements to absentee ballots (not just a serial number, but an actual photocopy of an ID),

Restriction on ballot drop boxes,

Reduced time to request and return absentee ballots,

Limited set times for early voting,

A full-on ban on early voting on Sundays, when Black voters participate in the famous “Souls to the Polls” voter drives that are one of the hallmarks of civic participation and democracy in the south.

The numbers on early voting and weekend voting in particular are remarkable, especially as they pertain to the Senate runoff elections:

The January 5 runoffs were the first time that Democrats outnumbered Republicans during in-person early voting, and Black voters constituted a third of early voters. In the November general election, Black voters used early voting on weekends at a higher rate than whites in 43 of 50 of the state’s largest counties. Black voters make up roughly 30 percent of Georgia’s electorate, but comprised 36.7 percent of Sunday voters in 2020 and 36.4 percent of voters on early voting days Fleming wants to eliminate.

It’s even worse than it sounds. Remember back last summer, during the Georgia primaries, when voting lines wound around blocks and blocks of Black neighborhoods? The average wait time in predominantly white neighborhoods was six minutes; the average in non-white neighborhoods was 51 minutes.

Remember during the first day of voting during the general election, when voters in Atlanta had to wait for 12 hours to cast their ballots? Instead of fixing these situations, they’re only going to make them worse.

Joe Biden won Georgia by a little over 12,000 votes. The voter ID law could easily discourage hundreds of thousands of voters from requesting a ballot or make it harder for them to send in their ballot — if you’re requiring a photocopy, that is absolutely a poll tax. There’s a reason why postage is pre-paid on absentee ballots, after all. By ending Souls to the Polls, you’re taking away the one day that many people have to vote at all, especially working parents and people who work tough jobs over long hours.

There is another hearing on these proposals on Monday, then they’ll be voted on and sent forward. Voting rights groups are scrambling to stop them, but it’s unclear how much they’ll be able to do so. Georgia Republicans can pass these bills because they have gerrymandered themselves a majority in the legislature that Democrats cannot break. These voter suppression laws would cement their full control of the state for a generation. It’s Jim Crow 2.0 and isn’t even trying to pretend otherwise.

There are no consequences when you choose your own voters. And this is the future we’re facing unless something dramatic changes.

I cannot emphasize enough how important it is that Democrats go all-out to pass the For the People Act and John Lewis Voting Rights Advancement Act in both the House and Senate. They must return the voter protections that were enshrined in the Voting Rights Act before it was gutted by John Roberts’ Supreme Court. To do so, they’ll have to kill the filibuster — Republicans are certainly not going to join in. I know Kyrsten Sinema and Joe Manchin have sworn against ending the filibuster, but Chuck Schumer, Biden, and the rest of the Democratic leaders must convince them to do so here.

Bad People Being Bad

OK, let’s do a rundown from here on out.

Texas Freeze-Out: The Lone Star State has a long history of shunning regulators and doing what its money-grubbing right-wing leaders want, especially when it comes to energy and oil. But it’s even worse than initially thought. This Houston Chronicle story couldn’t be more damning:

Late last year, as winter approached and power companies prepared for cold weather, Gov. Greg Abbott’s hand-picked utility regulators decided they no longer wanted to work with a nonprofit organization they had hired to monitor and help Texas enforce the state’s electric reliability standards.

The multiyear contract between the Public Utility Commission and the obscure monitoring organization, the Texas Reliability Entity, was trashed. Over the next months, right up until the crippling storm that plunged millions of Texans into the dark and cold, the state agency overseeing the power industry operated without an independent monitor to make sure energy companies followed state protocols, which include weatherization guidelines.

This didn’t cause last week’s catastrophe, but actual regulation could have prevented it.

BTW, if you want to read my take on Ted Cruz, that was part of our premium Thursday newsletter, but I’ll make it available just for you, right here.

New York: Last weekend, when I interviewed Assemblyman Ron Kim, he had some harsh words for Governor Andrew Cuomo, who had just spent nearly a year ignoring Kim’s requests for information about nursing home deaths and, as we know now, covering up the true fatality statistics in a truly unconscionable way. I thought the harsh words were well justified then and that was even before Kim revealed that Cuomo had called him a few days earlier and explicitly threatened him for doing his job.

Kim’s decision to reveal the basic thread of Cuomo’s threats unleashed an even bigger rampage. On Wednesday, the governor tore into Kim in a ferocious rant that did not particularly help his situation. The federal government is investigating his administration over the nursing home deaths, lawmakers in Albany are looking to strip him of his expansive emergency executive powers, and some have even discussed impeachment.

And you know what probably pissed him off the most? The SNL parody he got last night:

Rahm: Sending Rahm Emanuel, a proud asshole bully, to be ambassador to Japan, a nation that values respect and deference… seems like a bad idea. Using political capital on it, especially instead of fighting for a $15 minimum wage or voting rights… seems like a stupid idea.

Facebook: OK, they may take the cake for being the absolute worst this week.

Help Us Fight

Over the last three years, Progressives Everywhere has raised over $6 million more for dozens and dozens of grassroots activists, civil rights groups, and Democratic candidates.

And yet, there is so much work left to do. The goal is to continue to help these grassroots activists and organizers, support progressive Democratic candidates, and interview the experts and leaders so we can amplify their messages.

But none of the money we raise goes toward producing this newsletter or all of the related projects we put out there. Not a dime! In fact, it costs me money to do this. You’re already a premium subscriber, so I can’t ask much more of you… but if you wanted to give a gift subscription to someone, that would be pretty cool:

You can also make a one-time donation to Progressives Everywhere’s GoFundMe campaign.

Do you know what regressive means? «Far from being regressive, loan cancellation would be a particular boost to people of color, who have been exploited and/or cast aside by banking, the labor market, and higher education for generations.»