Billionaire tax should be a slam dunk for Democrats

Read the room, guys

Welcome to a Sunday edition of Progress Report.

It snowed all day yesterday in New York and resumed this morning. I’d grown indifferent to snow in the city, which almost instantly turns to dirty slush and turns traffic into bumper cars, but watching my three-year-old marvel at the snowflakes landing on his head and refracting on streetlights has renewed the wonder of it for me. Which is nice, because it feels like almost everything else in this country is going up in flames.

That grim feeling is a natural and eminently reasonable reaction to the onslaught of chaos in our streets and on our screens, but there are far more people fighting to fix problems and protect their neighbors than there are goons goose-stepping across our cities and towns.

If you’re or people in your community are fighting for justice — it could be against ICE or on behalf of something positive, like using government to address poverty — please get in touch. In a time when it’s going to take all of us to overcome the encroaching darkness want to use this newsletter to spotlight those frontline, grassroots efforts that are (or with help, could) make a difference.

Note: The far-right’s fascist takeover of this country is being aided by the media’s total capitulation to Trump’s extortion. It’s never been more critical to have a bold independent media willing to speak up against the powerful. That’s what I’m trying to do here at Progress Report.

You can help keep Progress Report afloat and build that network for just $5 a month — every subscription helps!

Invest in Billionaire Tears in California

It’s rough out there these days. Masked federal agents are terrorizing communities around the country. Innocent mothers are being shot in the face and smeared by the White House. Rent and home prices are at an all-time high. Healthcare is increasingly inaccessible for tens of millions of Americans. And some of the richest and most powerful people in the world might be asked to give a small fraction of their unfathomable wealth to make sure public hospitals can still operate.

Until Renee Good was murdered by ICE, the nation’s loudest and most-covered protests were emanating from the Twitter feeds and press offices of a handful of ultra-wealthy residents of California, who are losing their minds of a proposed ballot initiative that would place a 5% levy on the assets of the state’s billionaires. The one-time tax would collect tens of billions dollars, which would go toward filling the massive hole left in the state’s Medicaid system by the Trump administration’s spending cuts.

The establishment hysterics that consumed the NYC mayoral election are now playing out in California: Some billionaires are threatening to leave the state, others have already relocated, and there are apocalyptic warnings in the tech-centric business press about derailing innovation by asking the people who have more wealth than anybody in history to kick in a bit more to ensure a modicum of relief for those who have the least.

The follow through thus far has bordered on cheap satire: Peter Thiel and associates are pouring millions into an opposition campaign, the co-founder of Google dropped $175 million on two Miami estates to avoid being subjected to a tax to help poor people, and a subprime loan magnate worth $8.2 billion moved to Nevada because he “just felt a little bit like I wasn't wanted.”

None of the complaints, as specious and embarrassing as they are, come as any surprise. And just as unsurprising is the fact that the Democratic politicians who campaigned on solving income inequality are publicly siding with their billionaire patrons.

Democratic Gov. Gavin Newsom has long been against the proposed tax (they funded his political career), and he’s been joined in recent weeks by every major Democrat vying to succeed him in office: newly minted leftist billionaire Tom Steyer, former HHS Secretary Xavier Becerra, former LA Mayor Antonio Villaraigosa, and former Rep. Katie Porter, who supported a wealth tax while in Congress. Rep. Sam Liccardo, who represents much of Silicon Valley, has also been vocal about his opposition.

Misunderstanding the moment

Only one prominent California Democrat, Rep. Ro Khanna, another Congressman with constituents in Silicon Valley, has come out in favor of the wealth tax.

Khanna has tacked to the left as he mulls a presidential bid, and more than that, has taken on a populist tone that indicates a far better understanding of the political moment than Newsom and his would-be successors. They are allowing the media-purchasing power of aggrieved conservatives, public fuming of wealthy donors, and the hyperventilating of confused, self-mythologizing tech strivers to warp what should be a slam dunk political choice.

There are fewer than 300 billionaires in California, and some of them would likely be able to avoid the tax based on the form of their assets and liabilities. So really, about 200 people would be taxed a tiny portion of a wealth that they could not responsibly spend in a million lifetimes, a wealth that will continue to grow exponentially even if the one-time tax passes and is implemented. They might mope about feeling targeted, but there’s never been a more privileged class of people in all of human history, and everybody else — aside from perhaps the Silicon Valley aspirants who haven’t actually read the bill, take their cues from the hysterical libertarians who run their industry, and won’t actually be impacted — is fully aware that they won’t be directly impacted by the initiative.

The only way that billionaires can win this argument is by insisting that the tax will somehow hurt innovation and the state’s economy writ large, but that assertion isn’t some long-held economic rule, but a threat based solely on the whims of billionaires who simply don’t want to contribute anywhere near their fair share. And it falls apart when it’s stressed that this tax is only being proposed because billionaires pay perilously low taxes, skirting the social responsibility that the rest of us must uphold.

The tax would target the main way they avoid taxes: assets that are mostly illiquid, held up in stock and other paper properties. Instead of living within the means of their take home pay and bank accounts like the rest of us, billionaires take low interest loans against those assets to fund their lavish lifestyles, and pay them back here and there with stock sales. If they were paying normal taxes on these assets or loans, this kind of new tax wouldn’t be necessary, and the explosion in their net worths have made it abundantly clear to Americans

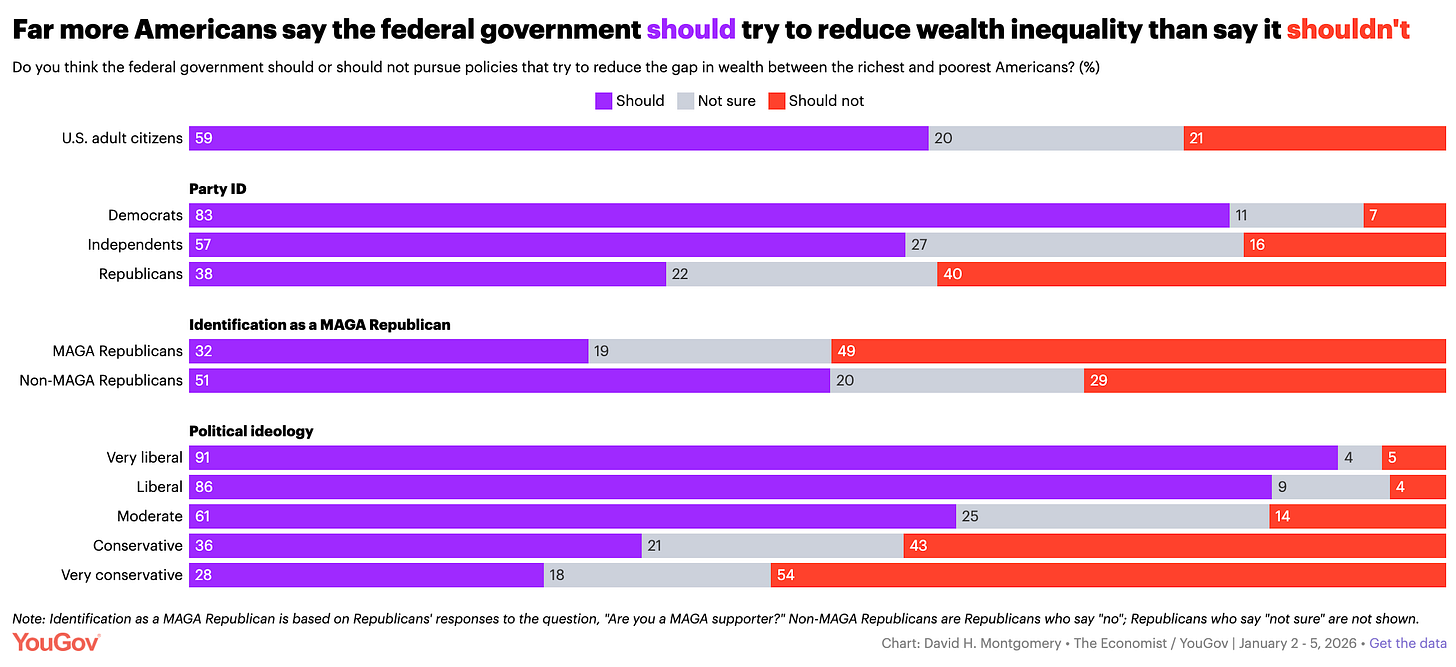

According to a new poll from YouGov, a full 80% of Americans think that the gap between rich and poor is a problem right now, including 52% of Americans who think it’s a very big problem.

What’s more, just about 60% of Americans believe that the federal government should take direct action to try to reduce income inequality.

And most relevant: 62% of Americans believe that billionaires are not taxed highly enough — including a plurality of Republicans, at 39%.

The counterargument is that broad policy polls are done in the abstract, before a lot of political advertising and discourse can influence the public’s opinion. But take New York, where the demand for a wealth tax transcended a relentless torrent of vicious political ads and media fear-mongering.

A poll taken in mid-October, in the thick of the mayoral election, found that voters statewide — not just in NYC — wanted to see tax increases on those who could pay more: 62% approved of an increase in the corporate tax for companies that make more than $5 million, while 64% were down with raising income taxes on the top 5% of earners — folks who make just over $600,000. California votes much like New York, so it’s a pretty fair comparison.

This isn’t limited to the two biggest blue states, either. In Washington State, Gov. Bob Ferguson, a relative moderate, is now backing a progressive tax on the state’s wealthiest residents, a group similarly dominated by big tech CEOs and early stage investors. And in Michigan, there’s an active ballot initiative movement to raise taxes on the rich to fund education.

And why wouldn’t Americans feel this way? They don’t just feel poorer, they’ve had inequality rubbed in their faces like never before.

The tech billionaires who are screaming bloody murder about this one-time tax are the same billionaires who got Donald Trump elected and then cashed in on the most corrupt administration in American history. They’re also richer than ever: the US’s top 10 billionaires’ personal wealth grew by nearly $700 billion in 2025 alone, which dwarves the amount of money that they’d have to pay to California.

Their earnings from this year alone could make up for nearly all of the GOP’s Medicaid cuts, and selling the shares necessary to provide that relief would actually be the politically and fiscally smart choice given the public backlash they’re facing. The smart move would be to shame them for acting monstrously selfish, for buying Miami compounds so that they can avoid helping struggling neighbors in the state that has given them so much. Donald Trump has proven that business leaders can be cowed; he does it for all the wrong reasons, but it’s a reminder of the utility of the bully pulpit. Bullying billionaires for the good of everybody else is the better version.

Democrats frequently campaign on raising taxes on the rich, and then, when in the majority, generally act as if they just don’t have the votes. Now, they are ceding the argument ahead of time. The billionaire tax is a prime opportunity to take a strong stance on behalf of working people, stand up to some of the most toxic public figures in the country, and prove populist bonafides while impacting fewer people than you might see at a wedding. It should be a slam dunk, not an occasion for cowardice.

Wait, Before You Leave!

Progress Report has raised over $7 million dollars for progressive candidates and causes, breaks national stories about corrupt politicians, and delivers incisive analysis, and goes deep into the grassroots.

None of the money we’ve raised for candidates and causes goes to producing this newsletter or all of the related projects we put out. In fact, it costs me money to do this. So, I need your help.

For just $5 a month, you can buy a premium subscription that includes:

Premium member-only newsletters with original reporting

Financing new projects and paying new reporters

Access to upcoming chats and live notes

You can also make a one-time donation to Progress Report’s GoFundMe campaign!

Contact the Governor | Governor of California https://share.google/GBgRtoz6bDzmVbOBS everyone should contact Gavin Newsome and let him know if he has aspirations of being president in 2028 he should get on the right side of this wealth tax, Remember public pressure works

Yes! Billionaires should pay their fair share FOR ONCE!